In 2022, the financial crime and regulatory landscape will proceed to be influenced by global trends and events including pandemic, supply chain challenges, fraud, cybercrime, NFTs, DeFi, cryptocurrencies and the growing risks of mutually organized and decentralized terrorism.

As the US, Europe and others make efforts to create better legal definition to crypto firms, a massive overhaul of regulatory frameworks will continue in 2022. In order to address deficiencies that have been previously identified to prevent being added to the FATF grey list, measures are designed. In addition, firms with deficient AML/CFT programs will have to deal with fines.

Throughout the global pandemic, financial crime incidents have been increasing as per Financial Action Task Force (FATF), the international anti-money laundering and preventing the financing of terrorism and proliferation (AML/CFT) standards body for financial crime. Specifically in the customer territory, the possibility for financial frauds has also soared. To address, numerous Payment Service Provider PSPs improved their controls including transaction monitoring, whereas regulators revised requirements concerning remote onboarding and on-going customer due diligence.

However, new regulations and technologies are frequently reshaping how compliance is applied and how financial crime is identified and inhibited.

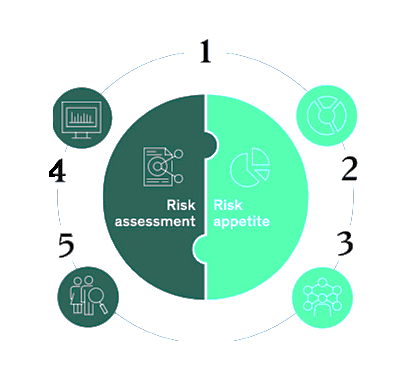

The five key trends for combating financial crime are aimed to secure the fundamental strengths and lessons learned from the experience of industry contributors. For shaping the strategy to fight financial crime, consider five core pillars:

Effective risk identification includes far more than simply developing high-level definitions and theoretical risk evaluations. It should include extensive, data-driven analysis of dealers' roles in the payment value chain, customer types and segmentation within their portfolios, business models and product offer, and transaction flows in terms of volume and kind. The information may then be used to establish risk appetite and related tolerance criteria for continued monitoring. All of this data should be regularly gathered and updated, with triggers integrated in the controls when there is a deviation from the risk appetite.

Risk management measures are considerably more focused and differentiated when they are segmented. Pursuing the goal of discovering and eliminating illegal activities and undesirable actors sometimes comes at a hefty operational expense. Enterprises lack the resources necessary to monitor all transactions and consumers equitably.

Concentrate more on the small segment of potentially risky transactions and clients. To accomplish this, institutions will need to create more detailed segmentation models based on real-time, up-to-date data in order to allow targeted detection and a clear classification of clients and transactions from lowest to highest risk. A model like this would reflect not only previous transactional data and static client information in Know-your-customer (KYC) files, but also looks ahead data points and external data on problematic performers.

This might include using data and controls for fraud detection and AML transaction monitoring to expose trends that indicate links to money laundering and other illegal activities. It may also require combining multiple anti-financial crime rules that apply to specific goods or services in order to reduce client conflict and improve overall effectiveness.

The use of current technologies and data will allow for the distribution of constant and trained monitoring systems, the design of which will be influenced by focused data analysis rather than expert opinion only. Additionally, intend to create intelligent automated processes by incorporating machine learning and analytical methodologies when appropriate. These practices have the potential to significantly enhance efficacy by reducing false-positive rates and support labor-intensive methods.

Majority of firms are creating AI models that use previous inquiry data to classify and focus on threats. Furthermore, they also use machine learning to promote dynamic optimization of transaction-monitoring scenarios. Analytics is more than just arranging machine learning and artificial intelligence; basic descriptive investigations using customer and transactional data (for instance, to understand expected customer behaviour) can often help experts save time, make better decisions, and organize more targeted controls overall.

Customer experience does not have to endure as a result of stronger anti-financial crime procedures. Instead, controls incorporated in client journeys can improve the customer experience.

To improve the customer experience, critical journeys including onboarding might be changed. Faster transaction speeds and improved ease of contact through digital channels, leveraging external data, and user-friendly interfaces might be among the features. Even basic initiatives, such as making requirements obvious, transmitting onboarding progress, or reminding customers of necessary reports, may improve the customer experience.

With the rise of financial crime, firms should continue to assess their compliance technology stack, examining how new technologies might help them achieve their goals, remove data, and fully implement a risk-based strategy. They should also evaluate their in-house team's abilities and expertise to see if/where additional views might offer value.