A lack of global effective action has frustrated attempts to prevent the concealment of company information, according to the Financial Action Task Force in response to the #PandoraPapers leak.

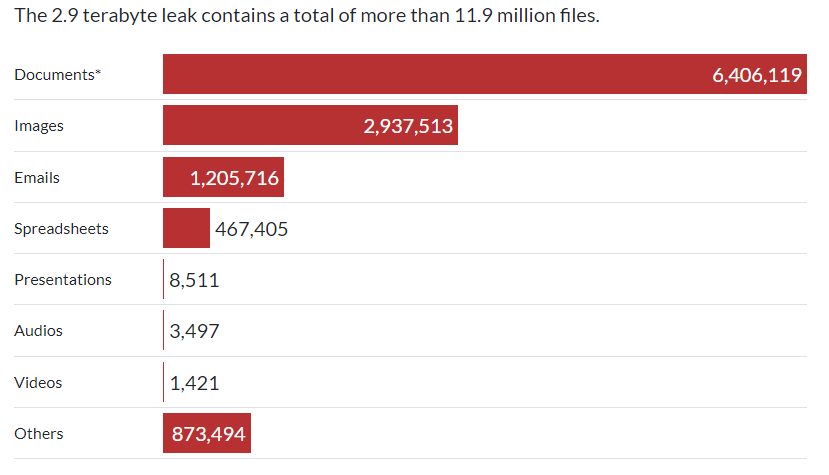

The Pandora Papers, a leak of over 12 million documents, revealed how global leaders and private actors exploit tax havens to conceal their riches, with the United States being a preferred destination.

In reaction to the revelation of the Pandora Papers, a bipartisan group of legislators presented the Establishing New Authorities for Businesses Laundering and Enabling Risks to Security Act (the "ENABLERS Act") on October 6, 2021.

The Enablers Act, proposed legislation, would alter the 51-year-old Bank Secrecy Act by forcing the Treasury Department to develop basic due diligence procedures for American gatekeepers who enable the flow of foreign funds into the United States.

The Pandora Papers and following proposed laws come at a time when global corruption and anti-money laundering are already under scrutiny, and they are consistent with recent US measures to improve monitoring and enforcement in this area. It remains to be seen if the bill can receive support in a divided Congress and be passed in its current form, but the concerns it addresses are those that generally draw bipartisan attention and action.

The ENABLERS Act directs the Treasury Department to develop rules requiring such enablers to:

The ENABLERS Act would exclude any government agency or attorney or law firm that hires a paid trust or company service provider, including a paid entity formation agent, operating in the United States from such duties. Furthermore, the ENABLERS Act expressly prohibits Treasury Department from exempting any of the above-mentioned enablers from regulatory obligations.

On October 21st, the Financial Action Task Force (FATF) ended its most recent Plenary, issuing crucial updates for compliance teams on cross-border payments, suggested amendments to Recommendation 24, and a new list of nations under intensified scrutiny.

The FATF is consulting with all parties involved in these adjustments before they are implemented. We are mainly interested in hearing from firms and other legal entities, financial institutions, designated non-financial businesses and professions (DNFBPs), and non-profit organizations, but we also invite input from other interested parties.

Only one-third of the nations evaluated in more than 100 mutual assessments have rules and regulations relating to the transparency of legal persons and arrangements that correspond with FATF requirements. Only 10% are taking appropriate actions to ensure corporate transparency and trust ownership.

The Pandora Papers include a lot of information for compliance professionals to unpack. Understanding the forms of exposure mentioned in the articles is a crucial first step, as is revisiting any customers whose risk level may need to be reviewed as a result. Adverse media screening might assist investigators in surfacing linkages when analyzing financial crime risks, especially given that so many leaked files are in the public domain.

Furthermore, The FATF condemned several companies for their approach to submitting suspicious transaction reports (STRs), claiming that it has "become more about technical regulatory compliance than effective risk management."

According to the FATF's findings, information sharing remains a serious concern, notably in the areas of risk monitoring, transaction processing, and sanctions screening. A deeper worldwide awareness of FATF rules is required, as are national registries for knowing your customer (KYC) and beneficial ownership information, as well as improved infrastructure to assure accuracy.

Essentially, not all nations are taking a risk-based approach, and AML/CFT laws are being implemented inconsistently. Both of these factors raise expenses, slow down processes, limit access, and reduce transparency. There are four major areas where diverse national approaches are producing issues:

The FATF has announced ideas to alter Recommendation 24 in order to strengthen transparency about beneficial ownership of legal persons.

The suggested amendments, which are especially topical in light of the Pandora Papers disclosures, include tightening the wording used in the Recommendation and making it as explicit and practical as feasible.

Increased surveillance jurisdictions are actively working with the FATF to resolve strategic gaps in their anti-money laundering, terrorist financing, and proliferation funding regimes. When the FATF places a jurisdiction under heightened monitoring, it implies that the government has committed to resolving identified strategic shortcomings as soon as possible within agreed-upon deadlines and is subject to further checks.

Customers should be screened against the FATF black and grey lists at onboarding and throughout their business relationship, and transactions should be monitored on a regular basis.

Moreover, to accurately screen, companies should ensure that their customer due diligence measures verify their customers' residence in, or business with, listed countries and that their transaction monitoring measures can examine the size, frequency, and pattern of transactions involving high-risk countries to determine whether a criminal activity, such as money laundering, is occurring.