Technologies equivalent to AI and machine learning can modify corporations to manipulate from huge information to ‘smart data’ to achieve insights into their own regulative practices. they will change advanced reporting; conduct meaning analysis of essential compliance risk areas and considerably broaden coverage with a comparatively low investment.

Where should these applications come from? Start-ups are on the rise; financial services companies have grown to be more effective in creating processes and defending their intellectual property. Leading financial institutions have filed more exclusive rights on an increasingly impressive range of innovative products. Many internal innovations are still focused on products. and services instead of RegTech, and the financial sector lags far behind the big tech companies.

Organizations should look into RegTech as part of the broader digital transformation process the industry is facing. While most institutions have created digital interfaces for their business, especially in consumer-oriented markets, these are based on legacy systems. A redesign of the central and administrative office as well as the headquarters including risks and compliance.

A sector under pressureFinancial institutions have confronted increasing regulatory burdens over the past 10 years. Compliance costs have risen steeply, especially for global companies operating in multiple jurisdictions. |

|

|

Reg Tech is among the fastest growing financial innovation elements. Reg Tech operates advanced analytics, robotic process automation, cognitive computing, and cloud technologies to achieve legal compliance and compliance more efficiently and competently. |

|

The industry spends a lot on digital transformation, especially delivery platforms. Compliance monitoring tools need to adapt to this new environment. |

|

It's easy to get carried away with new technologies that ultimately don't pay off. RegTech is still in its infancy for most financial firms and there are obstacles in the way |

|

Shareholders want management to show that they can meet regulatory requirements without investing more resources in the problem. |

|

Financial institutions turn to RegTech to help address compliance loopholes, cut costs, stay ahead of requirements, and identify risks before regulators do. |

|

APAC regulators are open to innovation and ready to support experimentation within the parameters of common sense. |

Regtech has a milestone that can change the industry’s compliance and value-added approach. RegTech's potential is framed by regulatory support, push for digital transformation, investment expansion, and an ever-growing list of success stories from startups and large tech companies eager to meet demand.

Some of the real-life examples include:

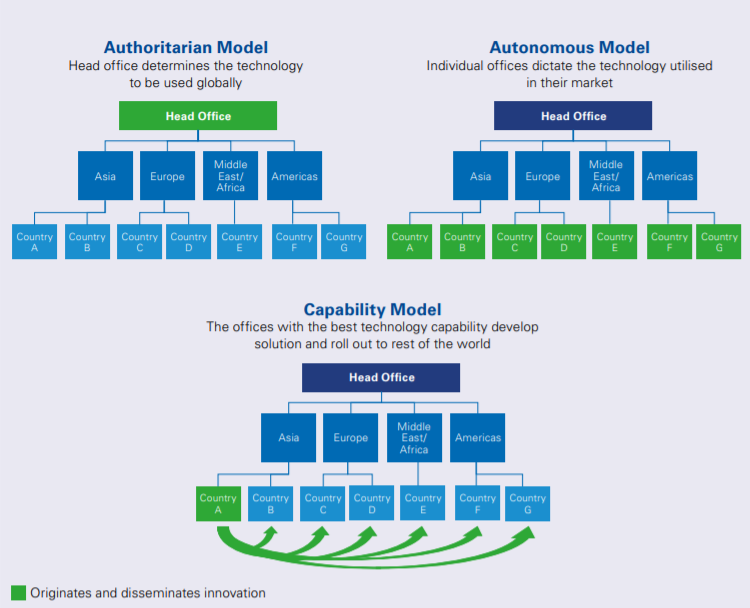

In addition to aligning compliance efforts across the enterprise, some global financial institutions could also consider how they are driving RegTech initiatives in the Asia-Pacific region as well as Asia Pacific offices. We believe this is a key factor in the relative delay in RegTech implementation in the Asia Pacific region.

However, we have seen some examples of market-leading organizations providing individual offices more autonomy to implement their own regulatory technology programs, especially when the region offers the greatest opportunity. This is an increasingly viable option for multinational companies as there are several benefits that can be obtained by using some of them. these tools as selective solutions for individual challenges, such as country-specific regulatory requirements. Alternatively, offices with better technological capabilities can try to develop their own solutions which can then be scaled and implemented in other markets.

RegTech – Recognizing the Challenges and Solutions |

|

|

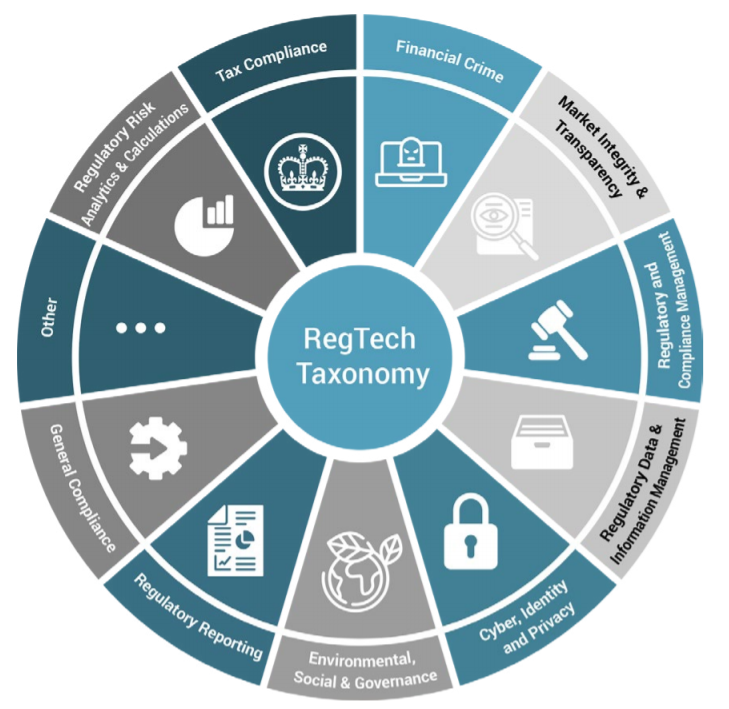

In the financial services sector, regulatory obligations range from complex calculations of capital requirements to ensuring fair treatment of customers: Today more than ever, regulation affects almost every aspect of a financial institution, be it a bank, an insurer, or an asset manager. In order to capture the variety of RegTech solutions available on the market, RegTech Associates has established a problem-oriented method for classifying RegTech products. RegTech Associates has a research database with more than 1,200 different RegTech products, which are categorized according to taxonomy and definitions |

|